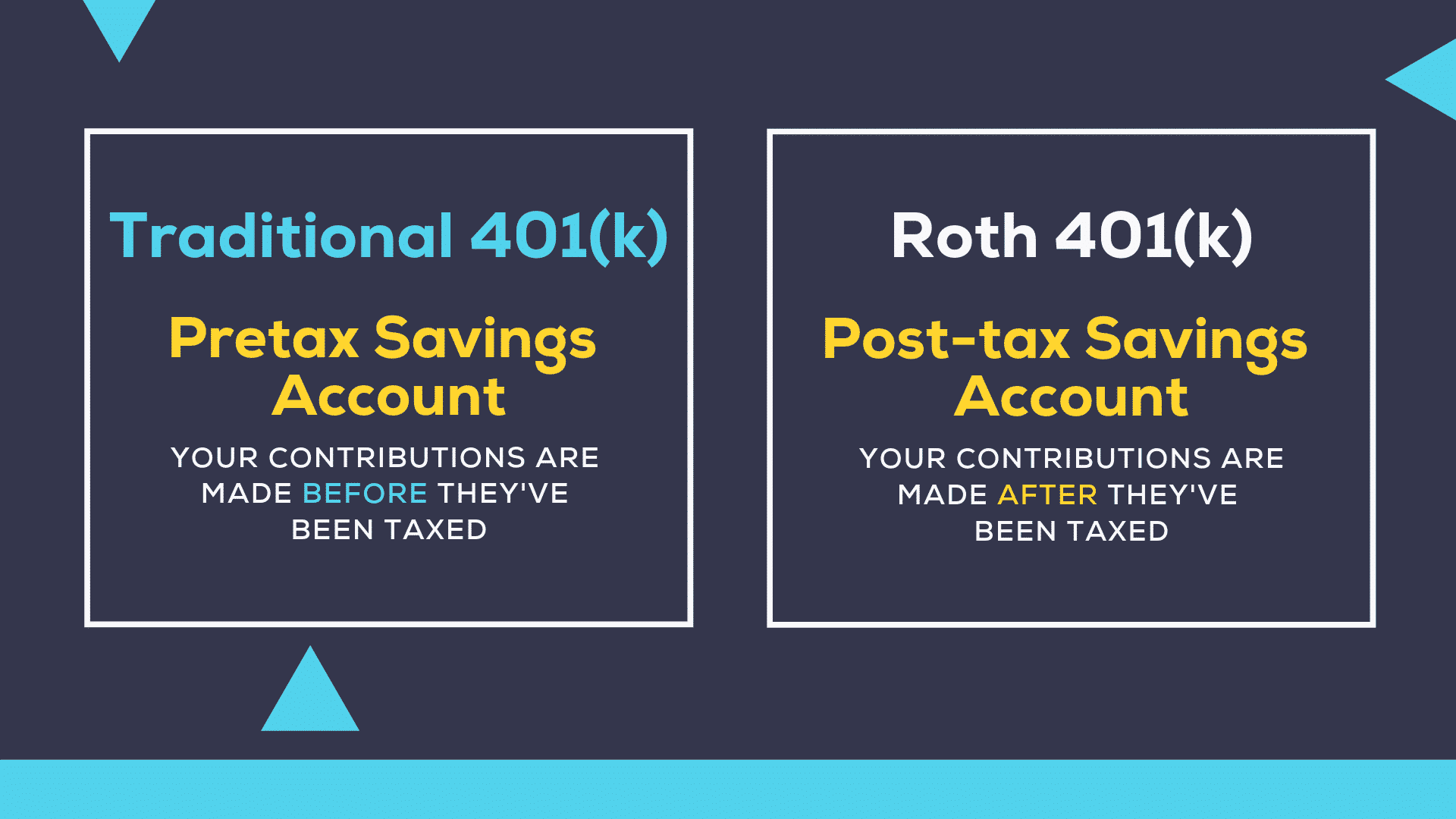

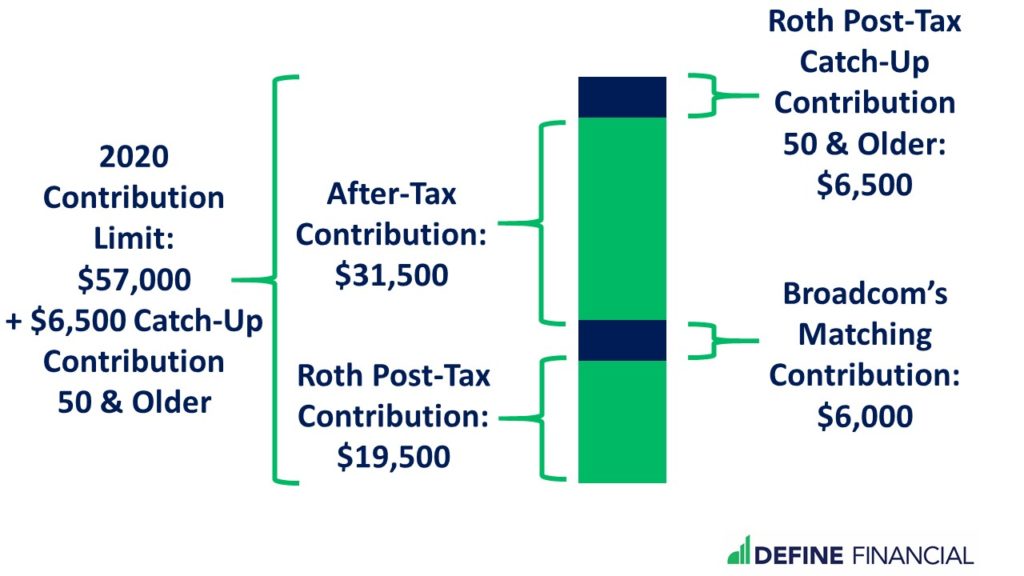

401k Max 2024 After Tax Roth. If you have both roth and traditional 401 (k)s, you can contribute to both every year as long as the total contributions don't exceed the irs limits for the year. Find out if your modified adjusted gross income (agi ) affects your roth ira contributions.

In 2024, the contribution limit for a roth ira is $7,000,. If you’re age 50 or older,.

401k Max 2024 After Tax Roth Images References :

Source: reinevkatharyn.pages.dev

Source: reinevkatharyn.pages.dev

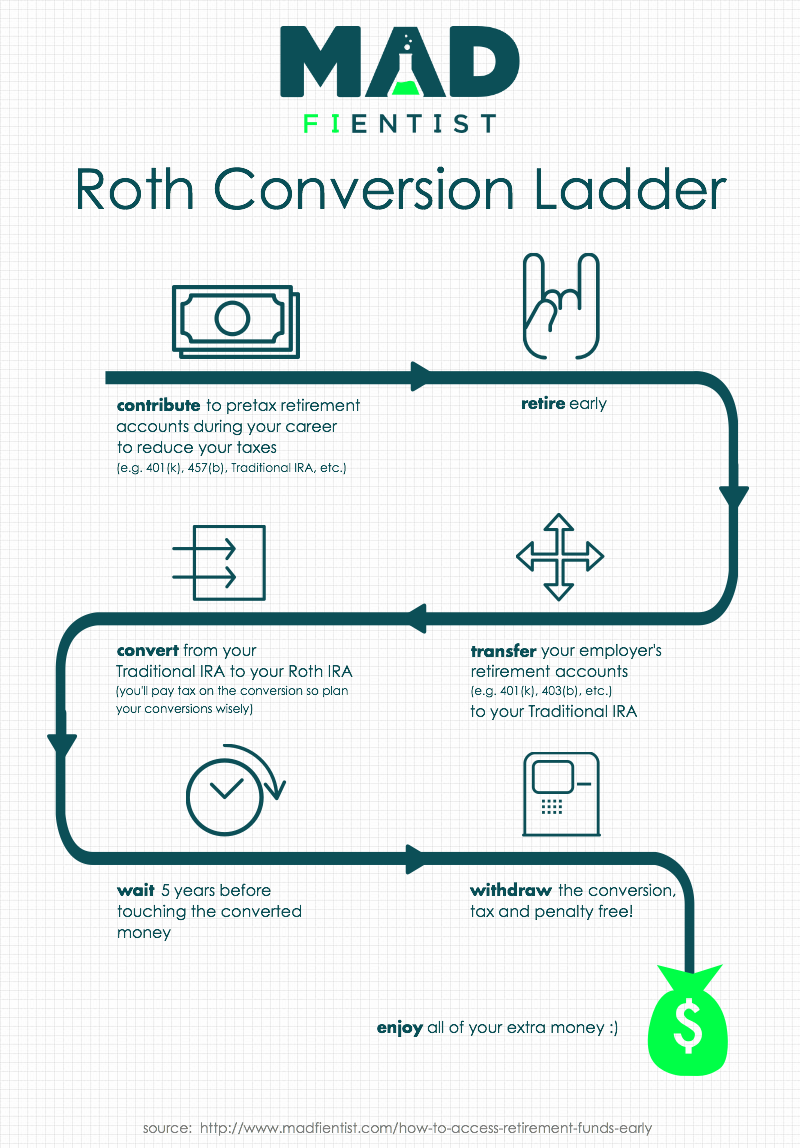

401k Max 2024 Roth Conversion Jojo Roslyn, This means you can put.

Source: loneebquerida.pages.dev

Source: loneebquerida.pages.dev

401k Limit 2024 After Tax Roth Karin Marlene, This means you can put.

Source: minnniewkoren.pages.dev

Source: minnniewkoren.pages.dev

401k Max Contribution 2024 Roth Lisa Renelle, The maximum amount you can contribute to a roth 401 (k) for 2024 is $23,000 if you're younger than age 50.

Source: reinevkatharyn.pages.dev

Source: reinevkatharyn.pages.dev

401k Max 2024 Roth Conversion Jojo Roslyn, Some of the potential strategies to look into might.

Source: berthermione.pages.dev

Source: berthermione.pages.dev

Max 401k And Roth Contribution 2024 Dulce Glenine, For most individuals, the roth ira contribution limit in 2024 is the smaller of $7,000 or your taxable income.

Source: lisebzorana.pages.dev

Source: lisebzorana.pages.dev

Max Roth 401k Contribution 2024 Vicky Marian, That means between the two.

Source: daffybcaprice.pages.dev

Source: daffybcaprice.pages.dev

401k Max 2024 After Tax Filing Dania Madeleine, In 2024, this rises to $23,000.

Source: agnesvkendre.pages.dev

Source: agnesvkendre.pages.dev

401k Max 2024 Roth Conversion Fina Orelle, Put very simply, the mega backdoor roth strategy entails 2 steps:

Source: berteyfelicle.pages.dev

Source: berteyfelicle.pages.dev

401k Limits 2024 After Tax Calculator Alfy Louisa, If you're age 50 or older,.

Source: hollybstarlene.pages.dev

Source: hollybstarlene.pages.dev

Roth 401 K Contribution Limit 2024 Employer Match Kally Marinna, If you're age 50 or older,.