No Road Tax For Electric Vehicles In Nc. However, as of last month, there’s only about 30,000 zero emission vehicles. The nc electric vehicle tax debate.

The maximum $7,500 federal ev tax credit consists of two equal parts: By next year, 6% of sales taxes will go to the state highway fund, producing more than $600 million a year primarily for roads and bridges.

Duke Energy Offers Residential Customers A $1,133 Rebate For Electrical Upgrades To.

Currently, the federal tax on gasoline is 18.4 cents per gallon.

Currently, Those Who Choose To Charge Up Instead Of Gas Up Don’t Have To Pay The State’s Gas Tax But That Will Soon Change.

But as more people switch to.

The Maximum $7,500 Federal Ev Tax Credit Consists Of Two Equal Parts:

Images References :

Source: www.moveev.com

Source: www.moveev.com

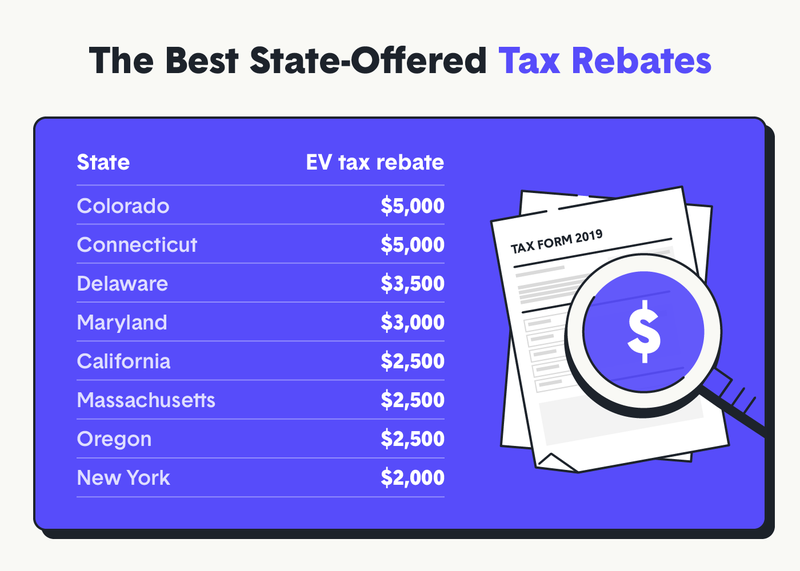

Complete List of New Cars, Trucks & SUVs Qualifying For Federal, North carolina ev tax credits guide. How are electric vehicles (ev) taxed in your state?

Source: www.thezebra.com

Source: www.thezebra.com

Going Green States with the Best Electric Vehicle Tax Incentives The, The number of electric vehicles on north carolina roads increased 54% in 2022 — a big jump for a single year — but evs still make up a tiny fraction of all. Qualified electric vehicles, dedicated natural gas vehicles, and fuel cell electric vehicles may use north carolina hov lanes, regardless of the number of occupants.

Source: www.leasingoptions.co.uk

Source: www.leasingoptions.co.uk

Is There a Road Tax on Electric Cars?, Currently, the federal tax on gasoline is 18.4 cents per gallon. In order to get the full amount, your ev or phev must.

Source: money.com

Source: money.com

2023 EV Tax Credit How to Save Money Buying an Electric Car Money, Sales of evs nationally in north carolina also are surging, although they still remain a fraction of overall vehicle sales. A 2018 executive order from north carolina gov.

Source: mypoisonedapple.blogspot.com

Source: mypoisonedapple.blogspot.com

Electric Vehicle Tax Credit 2023 Electric Vehicle Tax Credit Survives, Drivers of electric vehicles will have to pay the north carolina division of motor. Sales of evs nationally in north carolina also are surging, although they still remain a fraction of overall vehicle sales.

Source: www.svlg.org

Source: www.svlg.org

Reform tax credit for electric vehicles Silicon Valley Leadership Group, The number of electric vehicles on north carolina roads increased 54% in 2022 — a big jump for a single year — but evs still make up a tiny fraction of all. By next year, 6% of sales taxes will go to the state highway fund, producing more than $600 million a year primarily for roads and bridges.

Source: evwired.com

Source: evwired.com

Road Tax on Electric Cars The Complete Guide EV WIRED, In order to get the full amount, your ev or phev must. Currently, the federal tax on gasoline is 18.4 cents per gallon.

Source: benefitsfinder.com

Source: benefitsfinder.com

2023 Electric Vehicle Tax Credit, Qualified electric vehicles, dedicated natural gas vehicles, and fuel cell electric vehicles may use north carolina hov lanes, regardless of the number of occupants. In order to get the full amount, your ev or phev must.

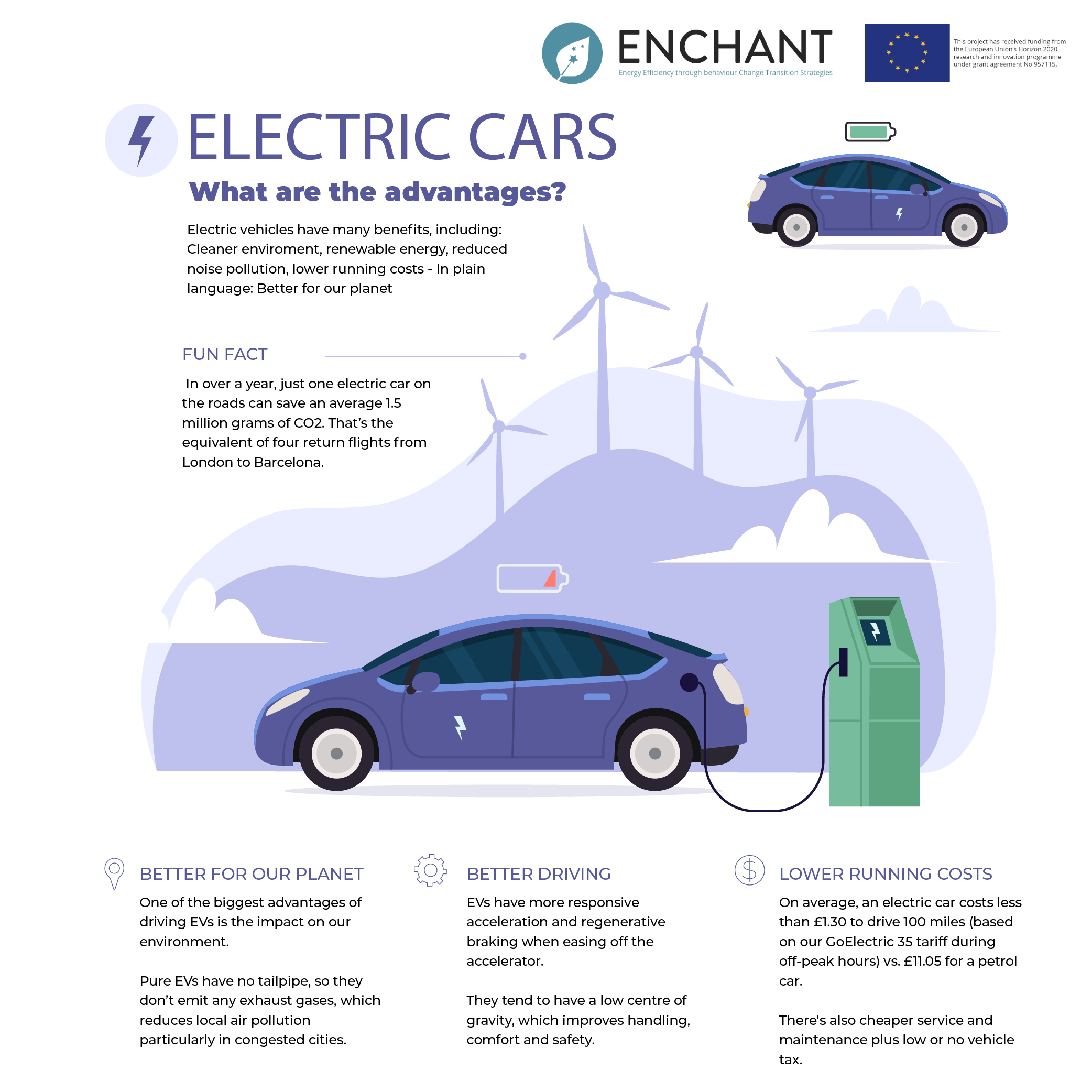

Source: enchant-project.eu

Source: enchant-project.eu

Electric cars What are the advantages? Enchant, Just as electric vehicle (ev) registrations have grown across the u.s., so has a new tax aimed at ev owners. The average state gas tax is 31 cents;

Source: newandroidcollections.blogspot.com

Source: newandroidcollections.blogspot.com

Electric Vehicles Qualify For Tax Credit Electric Vehicle Latest News, It ranges from 8 cents per gallon in alaska to 51.1 cents per. North carolina is not especially friendly to electric cars, at least in terms of incentives and credits granted to buyers and/or those installing home charging stations.

See Below For The Makes And Models You Can Get Your Hands On.

North carolina ev tax credits guide.

The Tax Brings In About $1.8 Billion A Year For The Ncdot.

Ncdot said electric vehicle owners pay about $50 less per year than gas vehicle owners when it comes to total taxes and fees for their cars.